What is Customer Acquisition Cost (CAC) and How To Correctly Measure It.

Customer acquisition cost (CAC) is a crucial metric for businesses that offer subscription-based products or services. It is the amount of money a company spends to acquire a new customer, and it is essential to understand how to measure it effectively. By measuring CAC, businesses can determine how much they can afford to spend on marketing and sales, and it helps them identify areas where they can improve their customer acquisition strategies.

There are several ways to measure CAC, and businesses can use different methods depending on their specific needs and goals.

Some of the most commonly used methods for calculating CAC:

- Simple CAC: This method involves dividing the total amount of money spent on marketing and sales by the number of new customers acquired during a specific period. For example, if a company spends $10,000 on marketing and sales in a month and acquires 100 new customers, the simple CAC would be $100.

- Blended CAC: This method takes into account all the costs associated with acquiring a new customer, including marketing and sales expenses, salaries, and overhead costs. For example, if a company spends $10,000 on marketing and sales in a month, pays $5,000 in salaries and incurs $2,000 in overhead costs, and acquires 100 new customers, the blended CAC would be $170.

- Ratio of Customer Lifetime Value to CAC: This method compares the customer lifetime value (CLTV) to the CAC. CLTV or CLV is the total amount of revenue a customer is expected to generate over their lifetime. If the CLTV is higher than the CAC, it indicates that the company is acquiring customers at a profitable rate. For example, if the CLTV/CLV is $500 and the CAC is $100, the ratio of CLTV to CAC would be 5:1.

- Payback Period: This method calculates the amount of time it takes for a company to recoup the cost of acquiring a new customer. For example, if the CAC is $100 and the monthly revenue generated by a customer is $50, it would take two months to break even on the cost of acquiring that customer.

To measure CAC effectively, you can use various tools and software solutions. Some popular tools for calculating CAC include Google Analytics, Kissmetrics, Mixpanel, and HubSpot. These tools provide businesses with detailed analytics and reporting features that help them track and measure their marketing and sales efforts.

For example,

if a company spent $10,000 on marketing and sales and acquired 100 new customers, the CAC would be:

CAC = $10,000 / 100 = $100

Once a company has calculated its CAC, it can use this metric to evaluate the effectiveness of its customer acquisition strategies.

By comparing the CAC to other key performance indicators (KPIs) such as CLTV, churn rate, and gross margin, businesses can identify areas for improvement and optimize their marketing and sales efforts.

For example, if a company's CAC is higher than its CLTV, it may need to re-evaluate its marketing and sales strategies to reduce the cost of acquiring new customers. Alternatively, if a company's CAC is lower than its CLTV, it may indicate that the company is not investing enough in marketing and sales and could benefit from increasing its marketing budget.

Businesses can also use CAC to compare the effectiveness of different marketing channels. For example, if a company is running a social media campaign and a Google Ads campaign simultaneously, it can calculate the CAC for each channel and determine which one is more cost-effective.

By regularly monitoring CAC, you can ensure that they are investing their resources wisely and optimizing their customer acquisition strategies.

This metric can also help businesses forecast their future expenses and revenue, making it an essential component of financial planning.

In addition to providing valuable insights into customer acquisition strategies, CAC can also have a significant impact on a company's bottom line. By reducing the cost of acquiring new customers, businesses can increase their profitability and achieve sustainable growth.

For example, if a company reduces its CAC from $200 to $150, and it acquires the same number of new customers, it can increase its profit margin and invest the saved resources in other areas of the business.

Moreover, by focusing on reducing CAC, businesses can also improve customer retention and increase customer lifetime value. This is because customers who are acquired at a lower cost are more likely to generate more revenue over their lifetime, providing a long-term benefit to the company.

There are various ways to calculate CAC, and you can choose the method that best fits your needs and goals. Tools and software solutions can also be used to track and measure CAC, providing businesses with detailed analytics and reporting features.

By regularly monitoring CAC, you can optimize their marketing and sales efforts, reduce your expenses, increase profitability, and achieve sustainable growth. As such, CAC is an essential component of financial planning and plays a significant role in the success of subscription-based businesses.

What is the industry standard for CAC?

The industry standard for Customer Acquisition Cost (CAC) can vary depending on the industry, the product or service being offered, and the specific business model. However, generally speaking, a CAC that is less than the customer's lifetime value (CLTV) is considered a good benchmark.

In other words, if a business is spending less to acquire a customer than the customer will spend with the business over their lifetime, then the CAC is considered reasonable. For example, if a business spends $100 to acquire a customer, and the customer will spend $500 with the business over their lifetime, then the CAC is considered reasonable.

It's important to note that there is no hard and fast rule for what constitutes a good or bad CAC, and it can vary widely depending on the industry and business model. For example, a SaaS (software as a service) business might have a higher CAC than a consumer goods company because the sales cycle for software is typically longer and more complex.

Furthermore, CAC can also be influenced by external factors such as market competition, marketing channels, and changes in customer behavior. As such, it's important for businesses to regularly monitor their CAC and adjust their customer acquisition strategies accordingly.

Overall, while there is no universal standard for CAC, it is generally considered good practice for businesses to aim for a CAC that is less than the CLTV of their customers. This can help ensure that the business is acquiring customers at a reasonable cost and is generating sustainable growth over the long term.

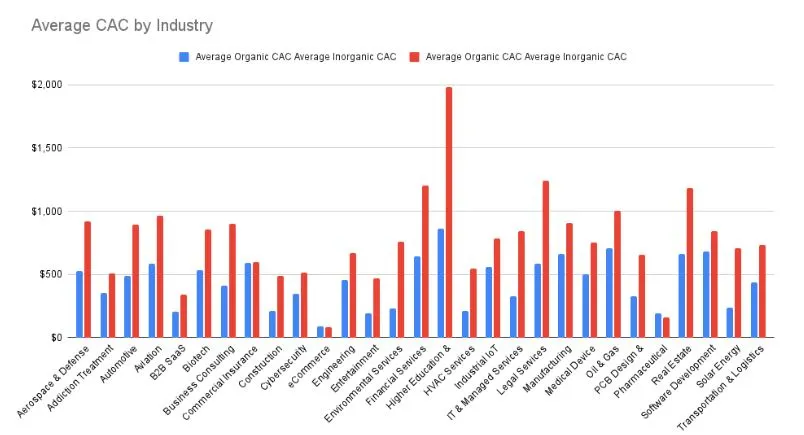

CAC for various industris:

The customer acquisition cost (CAC) can vary significantly between industries due to differences in target audiences, marketing channels, competition, and other factors. Here are some examples of the average CAC for different industries:

- E-commerce: The average CAC for e-commerce businesses ranges from $10 to $50, depending on the products or services offered and the marketing channels used.

- Software as a Service (SaaS): SaaS businesses typically have higher CACs due to the competitive nature of the industry and the need to invest in marketing and sales efforts to attract new customers. The average CAC for SaaS businesses can range from $100 to $1,000, depending on the product or service offered and the target audience.

- Healthcare: Healthcare businesses typically have higher CACs due to the regulatory requirements and complexity of the industry. The average CAC for healthcare businesses can range from $200 to $1,000, depending on the type of healthcare service or product offered.

- Finance and insurance: Finance and insurance businesses typically have higher CACs due to the competitive nature of the industry and the need to build trust with customers. The average CAC for finance and insurance businesses can range from $200 to $500.

- Education: Education businesses typically have lower CACs due to the relatively high lifetime value (LTV) of customers and the use of referral marketing strategies. The average CAC for education businesses can range from $10 to $50.

(Image Source)

(Image Source)

It's important to note that these are just general averages, and the CAC can vary significantly depending on the specific business, market, and marketing strategies employed. It's important for businesses to track their own CACs and compare them to industry benchmarks in order to identify areas for improvement and optimize their marketing and sales efforts.

15 strategies to improve the customer acquisition cost (CAC) of your business:

1. Optimize your website: Make sure your website is optimized for search engines and user experience to attract more organic traffic and improve the conversion rate.

2. Use targeted advertising: Use targeted advertising campaigns on platforms like Facebook, Google, and LinkedIn to reach your ideal audience with relevant messages.

3. Leverage content marketing: Create high-quality content that educates and engages your target audience and promotes your brand and offerings.

4. Referral Programs: Referral programs incentivize existing customers to refer new customers to a business. Dropbox is a great example of a company that used a referral program to reduce its CAC. Dropbox offered existing users additional free storage space for every new user they referred. As a result of this program, Dropbox's user base grew from 100,000 to 4 million in just 15 months.

5. Partner with complementary businesses: Partner with other businesses that target a similar audience and offer complementary products or services to cross-promote each other.

6. Attend industry events: Attend industry events and conferences to network with potential customers and industry experts.

7. Optimize your sales funnel: Analyze your sales funnel to identify areas for improvement and optimize the process for a smoother customer journey.

8. Invest in customer retention: Focus on retaining existing customers by providing excellent customer service, ongoing support, and exclusive offers.

9. Use email marketing: Use email marketing to stay in touch with potential and existing customers and promote new products or services.

10. Personalize your messaging: Use data and insights to personalize your messaging and offerings to individual customers based on their behavior and preferences.

11. Test different channels: Test different marketing channels and tactics to see which ones work best for your business and audience.

12. Improve your product or service: Continuously improve your product or service to meet the changing needs and expectations of your target audience.

13. Use social media marketing: Use social media platforms to build brand awareness, engage with potential customers, and drive traffic to your website.

14. Analyze your data: Continuously analyze your data to identify patterns, trends, and opportunities for improvement in your marketing and sales efforts.

15. influencer Marketing: Influencer marketing involves partnering with influential people in a given industry to promote a product or service. Glossier is a beauty brand that has used influencer marketing to reduce its CAC. Glossier partners with popular beauty influencers on Instagram and other social media platforms to promote its products. By leveraging the influencer's audience, Glossier is able to reach potential customers at a lower cost than traditional advertising.

By implementing these strategies, you can not only improve your CAC but also attract and retain more customers and drive business growth.

Each of these strategies has the potential to reduce CAC, but it's important to note that not all strategies will work for all businesses. It's important to experiment and find the strategies that work best for your specific business.

More Underground Strategies To Reduce CAC WITH case studies:

✅ Improve your customer onboarding process:

A streamlined onboarding process can help to reduce customer churn and increase customer lifetime value, which ultimately reduces the CAC. According to a case study by Invesp, improving the onboarding process can increase customer retention rates by 5% to 10%, which translates to a 30% to 50% increase in customer lifetime value.

✅ Use micro-influencers for marketing:

Micro-influencers are social media influencers with a smaller following but high engagement rates. By partnering with micro-influencers, businesses can reach a highly engaged audience and increase brand awareness at a lower cost. According to a study by Markerly, micro-influencers with 10,000 to 100,000 followers have an engagement rate of 2.4%, while influencers with over 1 million followers have an engagement rate of 1.7%.

✅ Implement customer loyalty programs:

Customer loyalty programs can incentivize customers to make repeat purchases and refer friends and family, which ultimately reduces the CAC. According to a study by Smile.io, customers who belong to a loyalty program spend 12% to 18% more than non-loyalty program customers.

✅ Use retargeting ads:

Retargeting ads can help to target potential customers who have already visited your website or interacted with your brand. By retargeting these customers, businesses can increase the chances of conversion and reduce the overall CAC. According to a study by Criteo, retargeting ads have a 10x higher click-through rate (CTR) than regular display ads.

✅ Offer a free trial or freemium model:

Offering a free trial or freemium model can help to reduce the CAC by allowing potential customers to try the product or service before committing to a purchase. According to a study by Intercom, companies that offer a free trial have a 25% higher conversion rate than companies that do not offer a free trial.

✅ Use chatbots for customer service:

Chatbots can help to improve customer service and reduce the workload on customer support teams, which ultimately reduces the CAC. According to a study by Comm100, using chatbots can reduce customer service costs by up to 30%.

✅ Leverage user-generated content (UGC):

User-generated content, such as reviews and testimonials, can help to increase brand trust and credibility, which ultimately reduces the CAC. According to a study by Yotpo, businesses that use UGC in their marketing campaigns see a 4.6% increase in conversion rates.

✅ Optimize your pricing strategy:

Optimizing your pricing strategy can help to reduce the CAC by attracting price-sensitive customers and increasing revenue per customer. According to a study by McKinsey, optimizing your pricing strategy can increase revenue by 2% to 7%.

One last weapon I can think of which may not directly improve your CAC but it definitely can indirectly help to reduce the customer acquisition cost (CAC), but it's not a direct strategy to reduce the CAC. The payback period is the amount of time it takes for a business to recoup its customer acquisition cost, and it is calculated by dividing the CAC by the average revenue per customer (ARPU).

By reducing the payback period, you can generate revenue faster and reinvest that revenue into acquiring new customers.

This can help to reduce the overall CAC because now you can afford to spend more on customer acquisition without affecting your cash flow.

However, reducing the payback period does not necessarily mean that you are acquiring customers at a lower cost.

To directly reduce the CAC, you can focus on

- optimizing your marketing and sales strategies,

- improving customer retention,

- leveraging referral marketing,

- and using data analytics to identify areas for improvement.

By reducing the cost of acquiring a customer, a business can improve its profitability and growth potential.

To summarize CAC and using the above strategies when you reduce it (Customer Acquisition Cost), you have several advantage for your business including:

👉🏻 Improved profitability: By reducing CAC, a business can improve its profitability by reducing the cost of acquiring new customers. This means that more revenue can be allocated towards other areas of the business, such as product development or customer support.

👉🏻 Increased customer lifetime value: A lower CAC means that a business can acquire more customers for the same amount of money. This can result in increased customer lifetime value, as more customers can generate more revenue over time.

👉🏻 Increased competitiveness: By reducing CAC, a business can be more competitive in its industry. This can help the business to attract more customers and grow its market share.

Overall, reducing CAC is an important goal for any businesses, and if you do it right the scope is unlimited!